The reason why REPL thought of creating such Fund was primarily because with infrastructure creation slowing down on part because lenders have become increasingly wary of lending to the sector, the Centre has plans to set up a dedicated bank to fund exclusively to the core sector projects. It was also ready to roll out an infrastructure trust fund aimed at mobilising long-term foreign investment within the next two months.

Rudrabhishek Infrastructure Alternate Investment Fund is an fund established or incorporated in India in the form of a trust or a company or a limited liability partnership or a body corporate which is a privately pooled investment vehicle which collects funds from investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors; and it is not covered under the Securities and Exchange Board of India Securities and Exchange Board of India Regulations, or any other regulations of the Board to regulate the fund management activities.

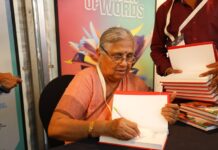

Mr.Pradeep Mishra Founder of REPL says:- “Rudrabhishek Infrastructure Trust is created as a Category I Alternate Investment Fund(SEBI). The motive of REPL of raising these fund was primarily because with infrastructure creation slow down lenders have became increasingly wary of lending to the sector Beside that the government has envisaged $1 trillion investment in the core infrastructure sector during the Twelfth Five Year Plan of which about 50% is expected to come from the private sector”. CCI Newswire