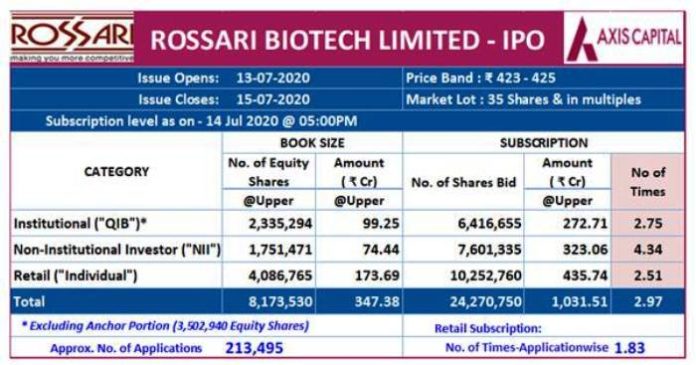

The portion reserved for Retail Individual Investors subscribed was 2.51 times, Non Institutional Investors 4.34 times and QIB investors 2.75 times.

New Delhi, July 20, 2020: The specialty chemical manufacturer IPO response on Day 1 saw a tremendous response from the retail segment where it was subscribed 0.92X, besides receiving QIB bids and HNI bids on the first day itself as per the 5.00pm cumulative figure available on both the exchanges.

Subsequently, the IPO issue has been fully subscribed on its 2nd day of which was announced open since 13 July, 2020. Bids of 24,270,750 shares were received against the offering of 81,73,530 shares. The portion reserved for Retail Individual Investors, Non Institutional Investors and QIB investors was subscribed 2.51times, 4.34 times, 2.75 times, respectively.

The price band for the IPO was fixed between Rs. 423-425 per share. On July 10, the company raised Rs. 148.87 crs from marquee anchor investors i.e Abu Dhabi Investment Authority, Malabar India Fund, Ashoka India Opportunities fund besides large domestic mutual fund houses like HDFCMF, ICICIMF, SBIMF, SUNDARAMMF and AXIS MF under various or individual schemes

Collectively brokerage houses such as Anand Rathi, Angel Broking, BP Equities, Choice Broking, Motilal Oswal, Ventura Securities, Narolia Financial Advisors, Emkay Global, Mehta Equities, GEPL Capital, Sunidhi Securities, Nirmal Bang as well as investor savy platforms like Chittogarh.com and Capitalmarkets.com have given a “subscribe” rating to the issue with a long term objective in mind, citing there is proof of concept and considering its inorganic and organic growth opportunities, R&D capabilities, post IPO debt free status and a strong demand for existing product lines.

Axis Capital Limited and ICICI Securities Limited have been appointed as the book running lead managers to the Offer

The last specialty chemical’s IPO to come to market was Neogen Chemicals in April 2019. It sought a good response from the market and found a subscription of 30.49X in the QIB Category, 113.88X in the NII Category and 15.86X in the Retail Category, totally 41.07X. The IPO came at a price of Rs. 215 per share on the higher side of the price band and is currently trading at Rs. 571 on BSE and Rs 570 on NSE.

Corporate Comm India(CCI Newswire)