Economic Environment of Peru

Peru is one of the best performing countries in Latin America. Over the past decade, Peru has been one of the region’s fastest-growing economies, with an average growth rate 5.9 percent and low inflation (averaging 2.9 percent). This scenario of high growth with low inflation can be attributed to a combination of favourable external environment, prudent macroeconomic policies and structural reforms in different areas..

Peru has experienced a drastic decline in poverty rates between 2005 and 2015. The significant growth in employment and income have reduced poverty rates, from 55.6 percent to 21.8 percent. It is estimated that in 2014 alone, 221,000 people escaped poverty in the country. Extreme poverty also declined dramatically, from 15.8 percent to 4.1 percent, during the same period.

After a downfall in GDP in 2014, the GDP growth recovered in 2015, from 2.4 percent to 3.3 percent, owing to increased inventories (mainly copper) and exports (3.3 percent). Private investment contracted by 7.5 percent as result of lower business confidence and sluggish real estate sector. The inflation rate exceeded the target range (4.4 percent) given the devaluation of the local currency, which drove up electricity rates and real estate prices.

In the forecast period, major challenges to be faced by the economy will include achieving more sustainable economic growth and further strengthening linkages between growth and equity. To this end, the country must take into account the segment of the population that could fall back into poverty as a result of economic fluctuations, which would reverse the progress made over the past decade.

Brief Overview of the Cards and Payment Industry in Peru

The government of Peru developed the National Financial Inclusion Strategy (NFIS) in July 2015. It aims to provide access to financial accounts for at least 50% of the adult population by 2018, and 75% of the adult population by 2021. The strategy promotes access to savings, insurance and financing, consumer protection, financial education programs and the use of electronic payment instruments. A rise in bank penetration is expected to drive demand for products such as bank accounts and debit cards.

In line with government’s financial inclusion program, the national mobile payments system Modelo Peru launched Bim mobile money, a fully interoperable payments platform, in February 2016. Through this, Modelo Peru aims to provide much of the unbanked population with access to digital financial services. It enables Peruvians with a mobile phone to open a bank account, transfer funds and make utility payments, and can be accessed with any basic mobile phone. Modelo Peru plans to have more than 2 million active Bim mobile money users by 2020. Modelo Peru is formed by the partnership of 40 Peruvian financial institutions, including private-sector and state-owned banks, credit unions, microfinance institutions, non-bank electronic money issuers and telecommunication companies.

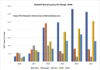

In terms of number of cards in circulation, the Peru payment cards market grew during the period 2012-2014 and it is expected to grow further over the forecast period. The increase in Peru’s GDP per capita and population is expected to increase the cards usage and also increase the card spending over the forecast period.

In Peru, the debit cards dominate the card payments market in terms of number of cards in circulation as well as in terms of number of transactions and value of transactions. The transaction value of credit cards reported at POS terminals was greater than at ATMs.

Major Players in Peruvian Cards and Payment Industry

Debit cards dominate the Peruvian cards and payment industry in terms of the number of cards in circulation and also in terms of number of transactions. Some of the key players in the debit cards market include Banco de Credito del Peru, BBVA Continental Scotiabank, Midbanco, Banco Financiero and Banco Falabella Peru. Banco de Credito del Peru was the leading bank in terms of the number of debit cards in 2014. Some of the key players in the credit card market of Peru include Banco Falabella Peru, Banco de Credito del Peru, Interbank, BBVA Continental and Scotiabank. In the credit card segment, Banco Falabella Peru was the leading bank in 2014, in terms of number of credit cards in circulation.

Peru’s Cards and Payments Industry Prospects

The growth of the Peruvian Card and Payments market is expected to continue in future. A large number of factors have contributed to the growth of the Peruvian card payments channel over the review period, both in volume and value. Examples of this include the government’s initiative to provide banking access through the financial inclusion plan, the growing popularity of payment cards, the availability of retail bank agents in every part of the country, and banks’ aggressive promotional strategies. Besides these, increase in disposable income and increasing market for mobile commerce and e-commerce have also contributed significantly to the growth of the Peruvian Cards and Payments Industry. With high mobile penetration, companies in Peru are increasingly using mobile technology with a focus on financial inclusion. Movistar, a mobile operator in Peru, in collaboration with MasterCard, introduced the country’s first electronic mobile money service, Tu Dinero Movil (Your Mobile Money), in January 2015. The service which is now available to Movistar’s more than 16 million customers is allowing them to conduct a number of transactions such as money transfers, purchases at MasterCard-affiliated establishments, and paying for mobile recharges.

Key Topics Covered in the Report

· Detailed profile of the Peruvian Cards and Payments Industry

· Competitive dynamics in the Peruvian cards and payments industry

· Historic and forecast values of Peru’s cards and payments industry

· Market trends and growth opportunities in the Peruvian cards and payments industry

· Marketing strategies used for various cards in Peru

· Regulations governing the Peruvian Cards and Payments Industry

Corporate Comm India(CCI Newswire)